Background

Al Rajhi Bank is one of the world largest Islamic bank from Saudi Arabia. This bank reached Malaysian shore on 2006 as part of it’s internationalization effort.

| Al Rajhi Personal Financing-i |

|---|

| Profit Rates start from 3.50% p.a. to 8.99% p.a |

| From RM 5,000 up to RM 150,000 or 5 times monthly salary financing available |

| Maximum 7 years repayment |

| No guarantor needed |

| Fast approval |

| Minimum of 25 years old and RM 4,500 monthly income |

Al Rajhi Personal Financing-i is an unsecured personal loan where no guarantor and collateral is needed which is 100% Shariah compliant. Al Rajhi’s personal loan is based on commodity trading. The guarantor requirements however do subject to applicant’s credit score.

Al Rajhi personal financing-i profit rates start from 3.50% p.a. to 8.99% p.a. This personal loan offers up to 5 times applicant’s salary or RM 150,000 (the lower amount) financing however this will also depends very much on the person’s credit score. The minimum someone can borrow is RM 5,000. Borrower will have options up to 7 years repayment. This loan features a speedy application, where applicants will know the application status in 24 hours upon complete submission.

Charges

There are no application and processing fees currently. However there will be a 0.5% stamp duty fees while Takaful insurance would be compulsory for the loan. Takaful Insurance will depends on age and tenure of financing by the applicants. This loan is subjected to Bursa fees. GST charges are also applicable for the service fees.

Eligibility

Age for age wise, Al Rajhi requires a much high 25 years age for loan application. Applicants should not be over 58 years old at loan tenure. This loan also has a minimum RM 4,500 monthly gross minimum salary for applications which is considered high for Malaysian standards. Overall, the standards set by Al Rajhi bank is quite high and thus is may be quite hard for average Malaysians to fulfill the loan requirements.

Documents required

- Copy and photocopy of IC ( Front and back)

- Most recent 3 months payslip and bank statement

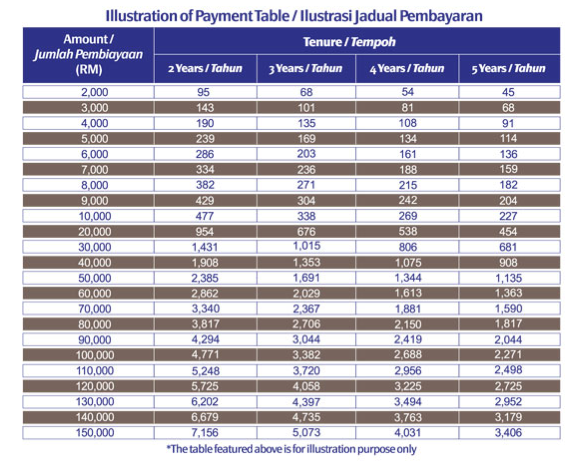

Al Rajhi Personal Financing-i repayment table is available below