| Alliance CashFirst Personal Loan |

|---|

| No early settlement penalty |

| From 10.38% interest p.a (Flat rate) |

| No guarantor and collateral needed |

| Aged from 21 years to 60 years old |

| Minimum monthly income of RM 3,000 |

| Maximum 7 years tenure |

| RM 5,000 to RM 50,000 financing available. |

| Malaysian Citizens only |

Alliance CashFirst Personal Loan comes with 0.865% monthly flat interest rate. This translate to 10.38% p.a flat rate which is roughly 17.86% p.a. (EIR) depending of tenure and amount loan. You can finance from RM 5,000 to RM 50,000 with a maximum 7 years repayment available with this package with minimum monthly payment of RM 103. RHB features a fast approval for this loan. This ensures that applicants will receive their loan once it has been approved.

Fees and Charges

There are no processing fees required for this loan. At the time of writing, there are no early settlement penalty provided you notify the banks 3 months in advance or you will need to pay at least 3 months of interest for early settlement. This perk will be very good if you have extra cash and deciding to settle your loan early. There is a standard 0.5% Stamping fees which is based on the loan amount. Any late payment will incur a 1% p.a penalty which starts from due date to settlement date.

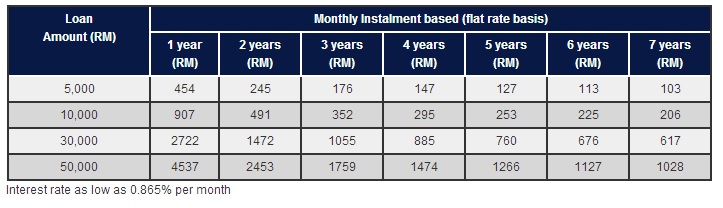

CashFirst Repayment Table

The table below represents the repayment for Alliance CashFirst based on RM 5,000 for 7 years repayment. Repayment for the loan can be done via IBG.

| Alliance CashVantage Personal Financing-i Islamic |

|---|

| Interest from 8.88% to 10.38% |

| No guarantor and collateral needed |

| Aged from 21 years to 60 years old |

| Minimum monthly income of RM 3,000 |

| RM 5,000 to RM 50,000 financing available with 7 years repayment |

| Malaysian Citizens only |

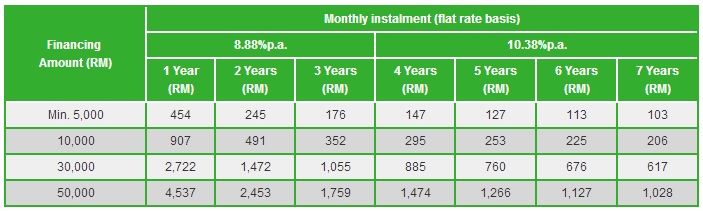

Alliance CashVantage Personal Financing-i is Shariah compliant loan based on Murabaha concept. Although being a Shariah compliant loan, this loan is open for all races and religions. This loan allows from RM 5,000 up to RM 50,000 financing with a minimum 1 year to a maximum of 7 years repayment. The loan is unsecured without requirement of guarantor and collateral. One notable difference between this loan and CashFirst would be the calculation of interest rates. Once can enjoy lower interest rates if you are opting for 1 to 3 years of repayment. This can incur some savings however with extra cost.

Fees and Charges

The requirement cost of this personal loan is very much the same with CashFirst except that this loan requires a compulsory Takaful coverage. This may not be a bad thing as insurance will cover the cost of repayment in the unfortunate event. Cost of insurance may varies based on age, tenure and loan amount. There is also a handling fees which is at 0.053%

Balance Refinancing

You can consider refinancing all your different outstanding credit card or personal loans to Alliance CashFirst for convenience purpose. Both CashFirst and CashVantage Personal Financing-i loan supports up to 4 credit cards or personal loans refinance at once.

Requirements

Alliance CashFirst and CashVantage is only available for Malaysian citizens and PR from 21 to 60 years old at the end of financing tenure. You will need a minimum income of RM 3,000 monthly t0 qualify for the loan.

Required Documents

Employed

- Photocopy of Malaysian Idendity Card ( Front and back)

- Details of banking account where cash is to be disbursed

- Most recent 1 month salary statement

- Most recent 6 months EPF statement

- Most recent income tax return form BE form with official receipt

Self Employed

- Photocopy of Malaysian Idendity Card ( Front and back)

- Details of banking account where cash is to be disbursed

- Most recent 1 month salary statement

- Copy of Business registration form ( Minimum 2 years in business )

- Most recent 6 months EPF statement

- Most recent income tax return form BE form with official receipt