| Bank Islam Personal Financing-i Package |

|---|

| From minimum of RM 10,000 to maximum of RM 200,000 financing available |

| Maximum 10 years repayment period |

| Stable position with minimum salary of RM 2,000 |

| optional Takaful Insurance |

| No guarantor needed |

| No processing Fees |

| Valid for Federal or State level Government servant and Government Link Companies (GLC) staffs only. |

Options of fixed or floating interest rates and Takaful Coverage. Having Takaful means that you can enjoy better interest rates and having protection for your installments in case of unfortunate incident. Floating interest rates would mean that your loan will be tied up with movements of BR with banks.

Takaful Coverage

FIXED

1 to 10 years : 4.99% p.a.

FLOATING

1 to 3 years: Base Rate + 2.25% p.a.

4 to 10 years: Base Rate + 3.15% p.a

Bank Islam Personal Financing-i is a loan package that is offered for public sectors and selected GLCs only. So the loan is not available for anyone working in the private sector. This product is Shariah compliant and is based on Tawarruq buy and sell concept. There are three interest rates tiers where you can enjoy better interest if you opt for selected Takaful products. The product includes TakafulWill writing, Banca Takaful or BankIslam Card-i. The amount of loan available is from RM 10,000 to RM 200,000. The loan amount would be subjected to criteria such as monthly income and credit score. Applicants can even loan more than RM 200,000 if they provide collateral as security to Bank Islam.

As of personal loans in Malaysia, there are no collateral nor guarantor is needed for the loan. However you may need a collateral or guarantor if you credit score is not strong. One point that differentiate this personal loan is there are options for fixed or floating interest rates. This may not be a good advantage during good economy times but is certainly beneficial during recession period where interest rates can shoot over 10% in Malaysia.

Repayment

The payment for Bank Islam Personal Financing-i is done via auto salary deduction or salary transfer to Bank Islam. The maximum deductable would be 50% to 60% of salary.

Fees

There are no processing charges when you apply for the loan however there will be a RM 50 chargeable Wakalah fees for this product. A 0.55% Stamp duty is also applicable which is based on the loan amount. A 1% p.a penalty will be charged for any late repayment. Personal Takaful Financing Plan (PTFP) is optional with the loan. This is to protect borrowers in the case of any unfortunately incidents.

Insurance

The loan comes with optional Personal Financing Takaful Plan which would protect applicants in the the unfortunate event of death or permanent disabilities. The rate would vary on factors such as age and risk. As a fule of thumb, the interest rates would go higher if Takaful plan is opted.

Eligibility

It is clearly stated that this loan is only offered to Malaysian Public Sector employees only. To be eligible for the loan, you will need to be a Malaysian citizen , 18 years old and above and having a minimum salary of RM 2,000 monthly. Private sector employee that is listed on Bank Islam panel companies such as Public Listed Companies, Goverment Link Companies is also eligible for the personal loan

Documentations

Applicants will have to bring the followings when applying for this loan

- Copies of IC on the front & back

- Most recent 90 days salary slip

- Most recent 90 days bank statement with salary credit account

- Employment confirmation letter, Details such as Name, IC number, Designation and Number of serving years

and any of these documents

- Most recent income tax submission form

- Most recent EPF statements

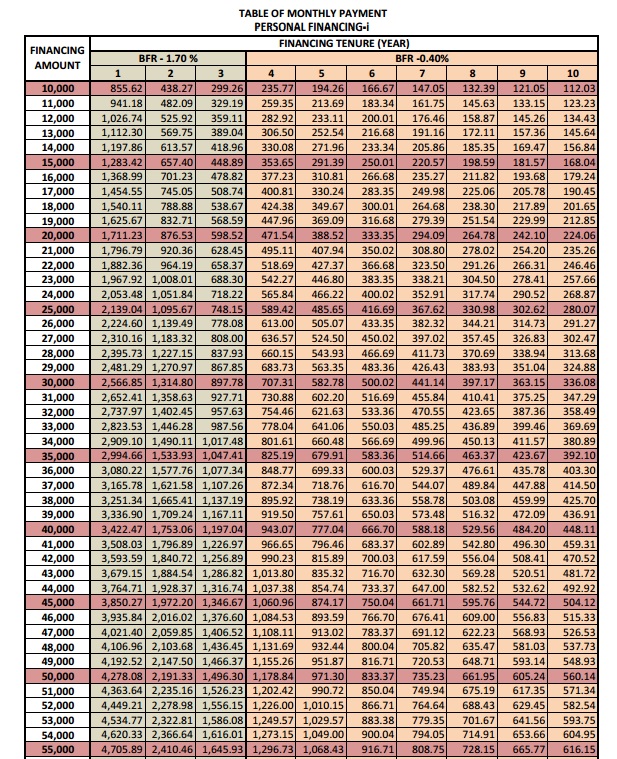

Repayment table

Pros

- Flexible choices between fixed and floating rates

- Low effective rates starting from 5.70% to 11.69% EIR

Cons

- Only available for public sector