OCBC Personal Financing

The Oversea-Chinese Banking Corporation Limited, abbreviated as OCBC Bank is the smallest local bank in Singapore with aglobal presence. OCBC Al-Amin offers simple and easily accessible Shariah compliant personal loan/financing service that has your best interest in mind. The suite of products give you advance cash at affordable rate and monthly payment to lighten your financial burden. There are no collateral and guarantor needed for the loan

OCBC Al-Amin Cash Financing-i provides:

- Fast approval. Fast cash

- No collateral. No guarantor

- Financing amount of up to RM150,000

- Fixed monthly installments from as low as RM 100 per month

- Extended financing tenure up to 10 years

Charges and Fees

There are no stamping and legal fees required for the loan. Early settlement penalty is applicable if borrower plans to settle the loan earlier. Applicants will have to write in letter in advance to the bank

Documentations

To apply, customers must be a Malaysian citizen or Permanent Resident earning at least gross monthly income of RM2,000. Permanent employment is also required

Documents required for application:

- Photocopy of Malaysian I/C (front and back)

- Photocopy of 1 month salary slip; OR 1 year EPF statement.

- Documents required

- Photocopy of I/C (front and back)

- Photocopy of 1 month salary slip; OR 1 year EPF statement.

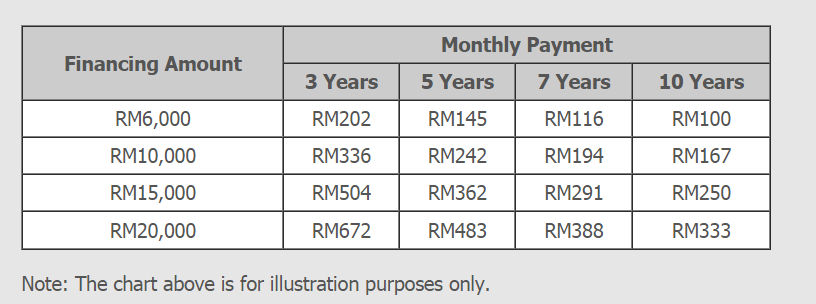

Repayment Table

There are a few loan concepts to suit the customers.

Progres-i Personal Loan

The ideal personal financing solution made for those who are just getting started. Whether it is one of life’s necessities or luxuries – be it education, car or gadgets; or perhaps you’ve hit one of life’s speed bumps, we will sort out your ideal plan. With varying tenures and monthly installments as low as RM147, you get personal financing that is just right for you

- Between 21 and 60 years of age

Sukses-i Personal Loan

Whatever your aspirations may be or wherever they may take you, you can rest assured we will be with you every step of the way. With long tenure up to 10 years and a profit rate as low as 0.71% a month, you get personal financing tailor-made to your needs.

- Between 21 and 55 years of age

- A holder of a Malaysian credit card with a limit of RM6,000 for at least 12 months and / or earning a monthly gross income of at least RM2,000

Prestij-i Personal Loan

Whatever the need, be it for the present or the future, you can rest assured we have your ideal plan that you so rightly deserve. With long tenure up to 10 years and an exclusive maximum financing amount of RM150,000, you get personal financing that is just right for you and your family.

- Between 21 and 60 years of age

- A holder of a Malaysian credit card with a limit of RM45,000 for at least 12 months and / or earning a monthly gross income of at least RM15,000