RHB Personal Financing-i for private |

|---|

| Profit rate based on loan amount |

| No guarantor and collateral needed |

| Interest from 15% to 24% p.a EIR |

| Aged from 21 years to 60 years old |

| Minimum monthly income of RM 2,000 |

| From 1 year to 7 years tenure |

| RM 2,000 to RM 150,000 financing available. |

| Malaysian Citizens only |

RHB Personal Financing-i for private is a shariah compliant personal loan from RHB bank that is catered for private sector. The profit rate of this loan would depends very much on the amount being borrowed.

| Amount | Profit rate | Max Borrowing Years |

|---|---|---|

| RM2,000 to RM10,000 | 13.47% | 5 years |

| RM11,000 to RM50,000 | 11.74% | 7 years |

| RM51,000 to RM 99,000 | 10.02% | |

| RM 100,00 to RM 150,000 | 8.31% |

Effective Interest Rates (EIR) may vary based on repayment period. As a rule of thumb, You will get better rates with higher borrowing amount and longer tenure.

RHB Personal Financing-i requires no collateral and guarantor. You can borrow 3.5 times your salary if you annual income is RM 18,000 to RM 30,000 or 5.5 times your salary if it exceeds RM 30,000 p.a.RHB Personal Financing-i comes with required Takaful insurance and express approval. There is a RM 10 stamp duty charge and brokerage fee of RM 30 per application for the loan. This loan is Syariah compliant loan and is based on ‘Murabahah and Tawarruq’ concept. The lowest amount that you can borrow is RM 2,000 which is at RM 57.54 repayment per month.

Interest Rates

The interest rates one can enjoy starts from 15% p.a. to 24%p.a EIR.

Cost

There is a RM 30 brokerage fee while Stamp Duty is chargeable. Takaful insurance would be compulsory with the loan in the event of death for permanent disabilities. GST of 6% is also applicable for any service charges.

Eligiblity

This loan is available to Malaysian Citizens that is 18 years while do not exceed retirement age at the end of loan tenure. This loan is also available to private sectors while the minimum salary required would be RM 24,000 yearly.

Benefits

This loan has no lock in period and early settlement fees if debtors want to settle the loan early. This is good if you expect a large sum of available money in near future, for example bonus,commission on sale.

Required Documents

Employed

- Photocopy IC (both sides)

- Most recent EPF statement

- Most recent salary slip ( 3 months if your income is not fixed)

Self Employed

- Photocopy IC (both sides)

- Most recent 6 months bank statement

- Latest income tax BE form

- Business registration certificate or Form 9, 24 ,49

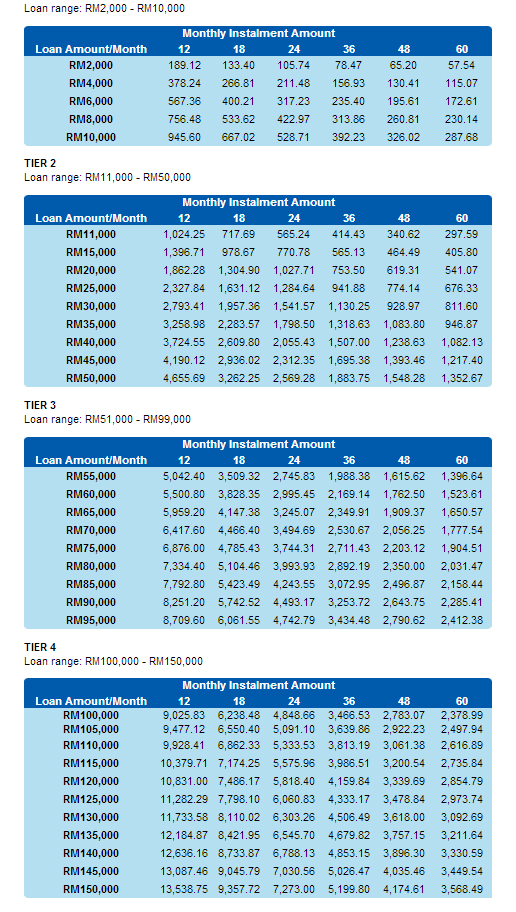

Repayment table

The repayment table for this loan is available below

*RHB Personal loan is not to be confused with RHB Easy Loan. These are 2 completely different products