Managing debt can be tricky if we do not monitor our finances from time to time. Most Malaysians today, have at least a car or a house loan tied individually or as a couple. Not forgetting the current trend of shopping, lifestyle hangouts and owning exclusive items has created a new wave of spending. It’s a cool trend to have, however we also must learn how to manage our spending and consolidate debt well.

There is a huge number of Malaysians today who fall in a serious situation to regain control of their debts. In Malaysian, through AKPK’s Debt Management Programme (DMP) we are provided with counsellors to develop a personalized debt repayment plan in consultation with financial institutions. It is important to manage debt to avoid becoming a defaulter and later be categorized as a bankrupt. Being a bankrupt will be very messy for us throughout our life, unless we get our finances sorted out.

Once our debt is well managed, it will improve credit scoring and enhance our relationship with our partner and family members. Bad debt management in many occasions leads to depression which may contribute to a higher rate of divorces and in some extreme cases may lead to suicide.

Here are some standard methods to manage our debts:

List down all the outstanding debt and total up the amount we owe (credit card, high purchase & mortgage), the monthly repayments and the interest due. By calculating this we will know the exact amount of debt we have. Don’t panic yet as there are ways to manage it. Once we get our paycheck, make sure all the loan payments are paid preferably before the due date to avoid any finance/interest charges. With internet banking, it’s much easier for us to make payments on time.

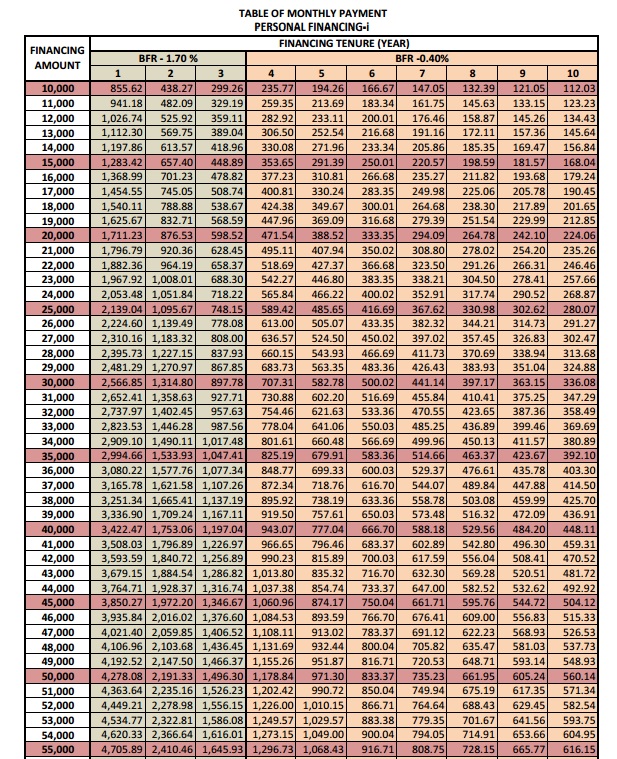

Contact the mortgage/higher purchase provider to renegotiate the terms of the loan. Just to be clear, this will not help to reduce debt, though restructuring the debt will make repayments easier to manage or shorten the loan repayment period.

Find a credit card company that offers a balance transfer deal. Use the balance transfer to consolidate debt. Transfer all the credit card debt onto the new credit card and gradually pay off to reduce debt.