Sometime early this year, Base Rate (BR) was implemented to replace the previous Base Lending Rate (BLR) system. Under the Base Rate system, this rate will be the main reference rate for new retail floating rate loans. Banks in Malaysia can also determine their interest rate based on a formula that was set by the Central Bank.

Unlike the previous Base Lending Rate system where Bank Negara sets the rate based on how much it costs them to lend money to other financial institutions, the rate under Base Rate is based on the Overnight Policy Rate (OPR) set by the central bank of Malaysia.

Why It Was Changed?

The Base Rate system encourages greater transparency from banks in Malaysia and it will also help customers to make better financial decisions. Some banks such as Maybank and Public Bank that are strong in consumer financing will have an initial competitive edge over other banks in offering more competitive and attractive base rates and effective lending rates (ELR) to their customers. In the previous base lending rate system, some banks were found lending out money below the base lending rate in order to attract more customers and to boost their loan growth. However, customers are no longer able to borrow money below the base rate under the new base rate system.

Banks Base Rate and Their Effective Lending Rates

Below is a list of banks in Malaysia along with their base rate and effective lending rates:

- Affin Bank – 3.8% Base Rate, 4.75% Effective Lending Rate

- Alliance Bank -3.82% Base Rate, 4.65% Effective Lending Rate

- Am Bank – 3.8% Base Rate, 4.45% Effective Lending Rate

- CIMB Bank – 3.9% Base Rate, 4.65% Effective Lending Rate

- Hong Leong Bank – 3.69% Base Rate, 4.8% Effective Lending Rate

- Maybank – 3% Base Rate, 4.55% Effective Lending Rate

- Public Bank – 3.52% Base Rate, 4.45% Effective Lending Rate

- RHB Bank – 3.65% Base Rate, 4.65% Effective Lending Rate

- Citibank – 3.65% Base Rate, 4.55% Effective Lending Rate

- HSBC Bank – 3.50% Base Rate, 4.85% Effective Lending Rate

- OCBC Bank – 3.72% Base Rate, 5.05% Effective Lending Rate

- Standard Chartered Bank – 3.52% Base Rate, 4.52% Effective Lending Rate

- United Overseas Bank – 3.85% Base Rate, 4.75% Effective Lending Rate

How Does It Affect the Borrowers?

This new change from base lending rate system to base rate system will only have minimum impact on the borrowers. For example, the rates offered by Maybank in the previous base lending rate system was 6.85% and the BLR -2.40%. This means that the borrower only needs to pay 4.45% on the mortgage. Under the new base rate system, Maybank will have to reveal its base rate and it must also disclose its margin which will be then used to determine the effective lending rate. Maybank’s effective lending rate was set to 3.20% and the interest presented here is +1.35%. This means that the effective lending rate that the borrower needs to pay on the mortgage is 4.55%, another 0.10% extra. Ultimately, the effective lending rate will be used to determine how much the borrower will have to pay the mortgage. Below is an example on how much a borrower will need to pay for a loan amount of RM550000 with loan tenure of 30 years:

- Reference Rate – 6.85% Base Lending Rate , 3.20% Base Rate

- Interest Rate – (-2.40%) Base Lending Rate, (+1.35%) Base Rate

- Effective Lending Rate – 4.45% Base Lending Rate, 4.55% Base Rate

- Monthly Instalment (RM) – RM2770 Base Lending Rate, RM2804 Base Rate

Please note that the examples shown above may vary in its effective lending rate if the base lending rate and base rate changes. With this new base rate system, the borrower needs to pay an additional RM34 per month. This additional figure amounts to RM12240 more by the end of the loan tenure.

Although some of the banks can set higher base rate compared to other banks, these banks can also offer lower effective lending rates to attract customers and to remain competitive. For example, Public Bank has a base rate of 3.65% and Maybank has a base rate of 4.55%. Public Bank can then offer a low effective lending rate of 4.45% while Maybank maintains their effective lending rate at 4.55%. In this situation, this means that Public Bank is willing to take a smaller profit margin so that they can remain competitive.

Base Rate Effect on Banks

So far, banks and mortgage providers are still going on with their usual business because the change from base lending rate to base rate has not significantly increased the effective lending rate. When it comes to the actual interest rates, the borrowers are still paying almost the same amount in the base rate system as they did in the base lending rate system. However, some of the experts said that this switch is beneficial as it will create a better transparency between the banks and their borrowers. Consequently, this will lead to greater competition among the banks in Malaysia to provide a huge range of loan options for their customers. According to Bank Negara Malaysia, the base rate system will also properly reflect the costs arising from monetary policy and market funding conditions. This will also encourage the banks and financial institutions in Malaysia to have greater efficiency and discipline when pricing their retail financing products.

However, this change may impact on some of the smaller financial institutions as they will start to lose out in the race to attract more borrowers due to the flexibility to determine their respective benchmark rates. Some of these smaller financial institutions may not have much leeway and resources to offer competitive rates when compared to bigger and more established banks and financial institutions.

Base Rate Effect on Property Demand

The switch from base lending rate to base rate is unlikely to have any effect and impact on consumer demand for property. In fact, the base rate system may even benefit home buyers and property investors for them to make better buying decisions because of the transparency in reference rate. These home buyers and property investors are also able to make more sound financial decisions by looking through an array of different loan products offered by various banks and financial institutions.

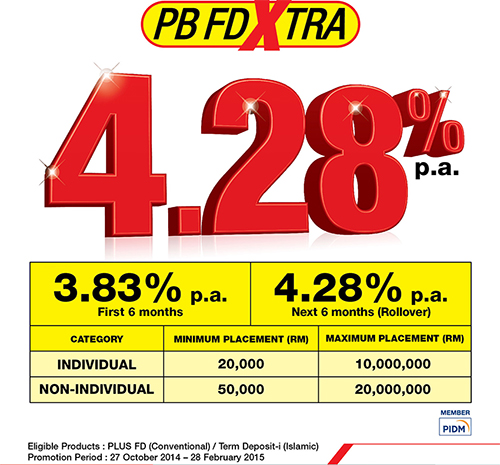

Good news for those of you who have plenty of money and nowhere to park it. Public Bank and Public Islamic Bank have team up again to come with high interest Fixed deposit plan in Malaysia. This promotion was previously available and now being launched again due to overwhelming response.

Good news for those of you who have plenty of money and nowhere to park it. Public Bank and Public Islamic Bank have team up again to come with high interest Fixed deposit plan in Malaysia. This promotion was previously available and now being launched again due to overwhelming response.