| BSN Executive 1 |

|---|

| Loan from RM 10,000 to RM 200,000 |

| Interest starts from 6.00% to 8.50% Fixed or Floating interest rates |

| Only available for staffs of selected panel companies, Telcos, Universities , Petronas group and panel of public listed companies |

| Aged from 21 years to 55 or 60 years old with minimum 3 years working experience |

| No guarantor and collateral needed |

| Malaysian Citizens only |

BSN Executive 1 or “Pinjaman Peribadi BSN Eksekutif 1” is a private sector personal loan product by Bank Simpanan Nasional. Although BSN Executive 1 is a private sector loan, it is only available to staffs of selected panel of private companies. This is not limited to selected companies such as Premium Developer Panel, Private Hospitals, Telcos, selected Public Listed Companies , Certified Professionals , Plantation Sector, Property Sector, Selected Private Colleges and Universities, Petronas group and Professionals such as Doctors and Lawyers.

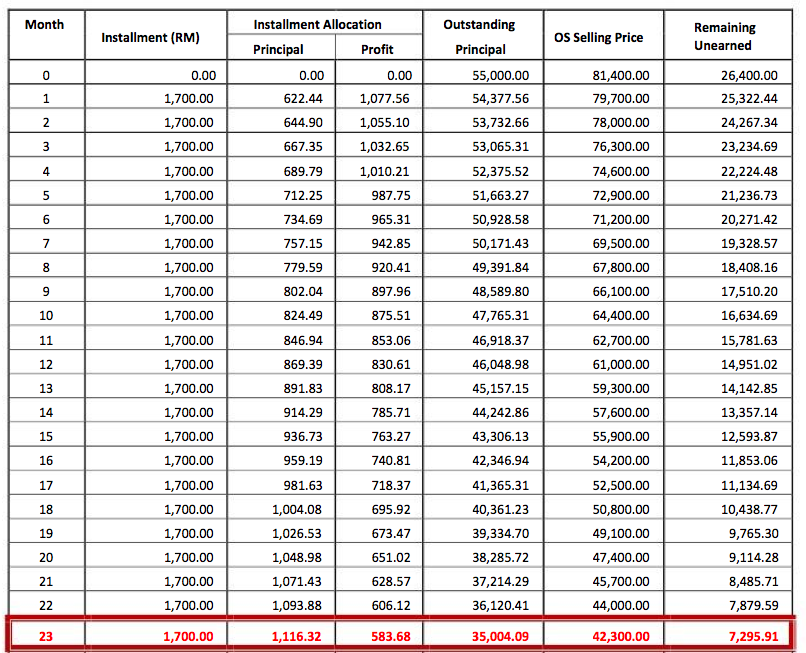

BSN Executive 1 will provide you from minimum of RM 10,000 to RM 200,000 of financing which will depends on your gross income. You can borrow up to 5 times your salary if you earn from RM 3,000 to RM 5,000, while 7 times when you earn from RM 5,000 to RM 10,000. The maximum that you can apply would be 10 times your monthly gross income if you are income is over RM 10,000. The repayment period for the loan is 2 to 10 years.

Interest Rates

The interest rates would depends on the applicant income level. Higher income level will give you better rates as there are lower risks to bank.

| Salary | Interest Rates |

| RM 3,000 to RM 5,000 | 8.50% p.a |

| RM 5,001 to RM 10,000 | 7.00% p.a |

| Above RM 10,000 | 6.00% p.a |

Fees and Charge

This loan is subjected to stamp duty as per Stamp Duty Act 1949. Applicants also will have the option to opt for insurance which charges would depends on applicant’s factor such as health and age. All late loan repayment is subjected to penalty of 1% p.a calculated on a daily basis. All service charge are subjected to GST Charges

Eligibility

You will need to have a minimum 3 years working experience and to be a Malaysian citizen to be eligible for the loan, this can be full employment or on contract basis which coming from selected panel of private companies. Applicants have to be minimum 21 years old while 55 to 60 years old at the end of the loan tenure. Applicant is also required to have a BSN Giro or Giro-i account holder which can be applied before the application of the loan. The minimum monthly salary for the loan application is RM 3,000.

Documentations

In order to apply for this loan, the following documentations are required

- Most recent 3 months salary slip

- Copy of Identity Card ( Front and back)

- Most recent KWSP statements

- Confirmation Letter of Employment with the following details ( Name , MyKad Number, Designation , Employment status, Salary, Employment date)

Or

- Latest EA form and income tax submission to LHDN.

Other things that you might be interested to know

There are no lock in period for the loan while applicant can fully settle the loan by writing in advance to the bank.

Pros

- This loan is available to private sector

- This loan is good if you have high income as you can enjoy lower interest rates and higher financing amount

Cons

- Very high minimum income requirement at RM 3,000 per month

- Application limited to select number of private companies, please check in advance