| Personal Financing-i Private Sector (Selected Panel Companies Only) |

|---|

| Minimum financing of RM 2,000 to maximum Financing of RM 150,000 to |

| Optional Takaful Coverage (Encouraged) |

| Minimum income of RM 2,000 depending on employment type and credit score |

| From 15 to 25 times salary financing available , the higher your pay, the more you can borrow |

| Malaysian citizen 18 years and above only |

Bank Rayat Personal Financing-i Swasta is the personal loan package that is catered for private sector professionals such as doctors, engineer, lawyer and public listed companies employees . This is a personal loan for private sector unlike typical loans from Bank Rakyat which is catered for public sectors. The loan is fully Shariah compliant while it is based on Tawarruq concept.

What is Tawarruq

Tawarruq is based in Islamic finance concept of buying and selling commodities. This concept allows borrowers to raise a certain amount of money easily without Riba.

Financing-i Swasta is a partially unsecured loan collateral is not needed however a guarantor may be needed when required by bank as a form of security. This loan offers from RM 2,000 up to RM 150,000 of financing. This amount of financing offered would a maximum of 5 times salary for those earning RM 2,000 to RM 4,000 , 15 times salary for those who are earning RM 4,000 to RM 6,000 and 25 times salary for those who are earning above RM 6,000 per month. The payment type also effects the amount that you can borrow from Bank Rakyat. As a rule of thumb, reliable constant payment such as Employer Salary deduction scheme will enable you to borrow more. This means that borrower who opted for PGM or Salary Transfer scheme can enjoy higher financing amount.

Payment options

The repayment for the loan can be done via Bureau Angkasa scheme, salary auto deduction or cash. There are various ways to repay the loan. These choices will effect the amount you can borrow and the interest rates you enjoy. On summary, one can enjoy better interest rates with auto salary deduction scheme.

- Electronic Payment

- Biro Perkhidmatan Angkasa

- Auto Salary Deduction

- Auto Salary transfer

| Employment Status | Length | Interest Rates |

|---|---|---|

| Selected Companies | 1 to 3 years | BaseRate + 16.28% |

| Salary from RM 1,000 to RM 1,999 | 4 to 7 years | BaseRate + 16.53% |

| Selected Companies | 1 to 3 years | BaseRate + 5.37% |

| Salary from RM 2,000 and more | 3 years and more | BaseRate + 5.52% |

| Not in Bank Rakyat’s Company list | 1- 3 years | BaseRate + 7.52% |

| Salary from RM 2,000 and more | 3 years and more | BaseRate + 7.67% |

Interest Rates

Interest rates of this loan would vary depending on loan amount. At the moment of writing, the interest rates provided by this loan is quite competitive among other private loans in Malaysia. You can also enjoy better rate if you pay via Bank Rakyat’s saving account and Takaful package while having higher salary and stable employement. The table above summarizes the interest rates for Bank Rakyat Personal Loan. The rates are tied with Base Rate from Bank Rakyat. Interest Rates are negotiable based on profile of the private company one is attached to.

At the time of writing Bank Rakyat’s base rate is 3.85%

Fees

This loan subjected to 0.5% stamp duty which is based on the financing amount based on Stamp Duty Act 1949. This fee will be deducted from the amount borrowed. Borrower is advised to purchase Takaful insurance although it is optional. There is a 1% p.a penalty for any late payment. There is a compulsory RM 30 Wakalah fees. All service charges are subjected to GST charges.

Eligibility

This loan if available for Malaysian Citizens from 18 years and above while not exceeding your retirement age during the whole loan tenure. This loan has one of the youngest requirement for age. Typically a Malaysian personal loan would start from 20 years and above. You will need to have a minimum monthly income of RM 2,000 to qualify for the loan. Personal Financing-i Swasta is only catered for professionals from private sectors. Fixed employment is required while contractual employees are required to have a minimum monthly salary of RM 8,000.

Permanent employee from manufacturing sector that is from Bank Rakyat’s company list with minimum salary of RM 1,000 can also apply for the loan. This loan is factory worker’s friendly. However borrowers are advised to check with Bank Rakyat on the private company panel list. Bank rakyat as a list of GLC who are eligible to apply for the loan.

Repayment

There are various ways repayment methods for the loan.

- Cash

- Bank transfer to Bank Rakyat

- Bureau Perkhidmatan Angkasa (BPA)

- Direct Salary Deduction

- Electronic payment

Documents needed

- Photocopy IC on both sides /Army IC or Police IC

- Latest 3 months payslip

- Latest 6 months EPF statement

- Confirmation employment letter

- Most Recent BE form / LHDN Tax return form

Pros

- Very low interest rates

- Auto salary deduction (BPA available)

- Manufacturing sector friendly. If applicant with income RM 1,000 monthly can also apply if they are working on Bank Rakyat’s company list

Cons

- Only panel companies listed by Bank Rakyat are eligible. There are limited number of companies and GLCs in the list at the moment

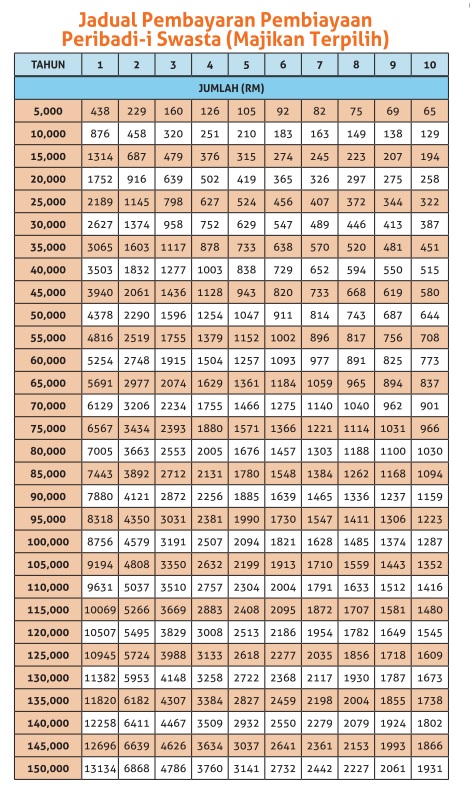

If you are keen, Financing-i Swasta repayment table without Takaful is available below.

Branches

Bank Rakyat has branches spread across states in Malaysia and peninsular Malaysia