CIMB Personal loan is one of the most popular choice of personal loan in Malaysia. At the moment CIMB offers may type of personal loan ranging from Syariah compliant loan, public sector loan to secured loan. Here are some of the loans from CIMB Bank and CIMB Islamic bank.

CIMB Cash Plus Personal Loan ( Private Sector)

Cash Plus Personal Loan |

|---|

| From 8.20% p.a. to 14.66% p.a. (Flat Rate) |

| No guarantor and collateral needed |

| From RM 2,000 to RM 100,000 of financing |

| Loan tenure from 1 year to 5 years |

| From 21 to 60 years old |

| Compulsory insurance and stamp duty |

| Malaysian Citizens only |

Cash Plus personal Loan is an unsecured loan where no collateral and guarantor is needed. You can loan from RM 2,000 to RM 100,000 however that would depends on your gross income. The rule of thumb would be that you can only loan up to 8 times your gross income with CIMB Cash Plus personal loan. This is a full disbursement loan where you get the amount that you applied for

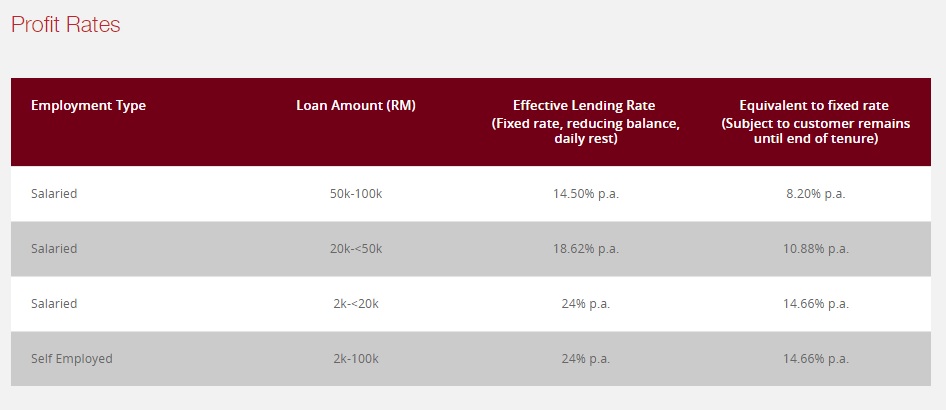

Cash Plus personal Loan interest starts from 8.20% p.a. to 14.66% p.a. The interest would depends very much on the loan amount and your employment type. Typically you can enjoy better interest rates with the higher loan amount and better employment terms.

Interest Rates

The interest that you can get varies from your loan amount and tenure. Generally you can enjoy better interest rates if you are fully employed and your loan amount is higher.

Charges and fees

There is a 0.5% stamp duty and insurance which is required for taking up this personal loan. Any late repayment will be subjected to 1% p.a penalty on a daily basis. Applicants can fully settle the loan without any penalty fees with a 1 month in advance writing.

Eligibility

To be eligible for the loan, you need will a MyKad while having a RM 2,000 basic income. Loan is only for applicant aged from 21 years old to 60 years old.

Documents required

Employement

- Photocopy Identity Card both sides

- Most recent 3 months payslip

- EFP statement/Income tax form/Employment letter

Self business

- Photocopy Identify Card both sides

- Business registration certificate

- Most recent 3 month bank statement/ EA form

If you are keen, you have can a look at the repayment table on the link below

Pro

- No early settlement fees for this loan , need 1 month advance in writing

Cons

- Very high interest rates especially if you are self employed

Xpress Cash Financing-i

| Xpresss Cash Financing-i |

|---|

| From 5.55% to 5.25% p.a (flat rate) |

| No guarantor and collateral needed |

| From RM 3,000 to RM 50,000 of financing |

| 6 months to maximum 5 years financing |

| Aged from 21 years to 59 years old |

| Public sector (Government) staffs, related GLCs and MNCs only |

| Minimum income of RM 800 |

CIMB Xpress Cash Financing-i is personal financing that is catered for selected Multinationals , GLCs and Malaysian public sector employees. The profit rate starts at 24.00% p.a flat rate. There are no collateral and guarantor needed for the loan application. The loan tenure ranges from 6 months to 5 years.

The maximum you can finance would be RM 50,000 with 10 years repayment period. However this will also depends very much on amount deducted from your salary. Borrower can enjoy up to 8 times their gross salary.

The standard figure is 60% of the auto salary deduction. As of all government loans, payments for this loan is done automatically via Biro Angkasa. This loan comes with Takaful coverage that will protect you in case of accidents.

Charges and fees

There is a stamp duty of 0.5% based on the financing amount.

Eligibility

You will have to be employed with selected MNCs , GLCs or Public sector. One has to be from 21 to 60 years old to be eligible for the loan while with a minimum earning of RM 800. This loan is open to Permanent Residents and Malaysian Citizens.

Documents required

- Photocopy IC both sides

- Most recent 3 months payslip (Certified true copy)

- Bank statement of salary credit

- Income Statements

Pros

- This loan features a 24 hours speedy processing

- Very low RM 800 minimum salary requirement

Cons

- Extremely high interest rates at 36.82% p.a.