Everyone should know what a fixed deposit is. It is a personal investment platform in which an amount of money is kept and given to either a bank or financial institution where the recipient will pay interest to the depositor at certain specified rate. Do take note that the rate of interest paid will differs from bank to bank, amount given and duration of time. Many people are investing more and more in fixed deposit especially foreign currency fixed deposits in Malaysia as it is considered as a safe haven for investors. Foreign currency fixed deposits are basically fixed deposits that are maintained in banks in Malaysia but in foreign currency instead of Malaysia Ringgit. Most banks in Malaysia offer this type of fixed deposits in major currencies like the US Dollar, Euro, Japanese Yen, Pound Sterling and Australian Dollar. More investments on fixed deposit as this is mainly because this type of investment does not have any risks. Moreover, it guarantees a high return as interest will be paid for depositing the money.

Foreign currency fixed deposits are one of the smart ways to counter the growing inflation and currency fluctuations. It is also a great financial tool for those of you who deal with currencies other than your own national currency. Besides, it is good for those who have business all over the world. It sounds as good as it can be but bear in mind that the account opening for such fixed deposit is highly subject to guidelines published by the Bank Negara. There are quite a number of banks in Malaysia that are offering foreign currency fixed deposits to its Malaysian customers. Some of the banks are offering the foreign currency fixed deposits in both conventional and Islamic banking variants, which you can check out for further details with the respective banks.

Maybank is considered as the most preferred and common bank for the Malaysians. Maybank offers a wide range of deposit schemes to its customers with the foreign currency fixed deposit as one of them. The purpose of the scheme is for those of you who are interested to deposit money in other currencies in order to hedge inflation. Maybank is one of those banks that offer both the conventional and Islamic banking variants. Another common bank to the Malaysians is the CIMB Bank. Its foreign currency fixed deposits are available in popular currencies like the US Dollar and Euro, which offers flexibility in making deposit and withdrawals through cheques, drafts and telegraphic transfers.

HSBC is also offering foreign currency fixed deposits along with PIDM protection. It is an excellent method to make savings in foreign currency and earn returns at the same time. It is also good for hedging against fluctuations in exchange rate. You can hold the deposit until you find the exchange rate beneficial for you. HSBC fixed deposits are available in almost all foreign currencies. Foreign currency fixed deposits from Ambank are also eligible for PIDM protection a stated in the guidelines prepared by the bank. If you choose Ambank, do take note that it offers these fixed deposits in both forms, either as deposit or current account. Similar to other banks, it is available in almost all major currencies and it provides remittance facility in most countries.

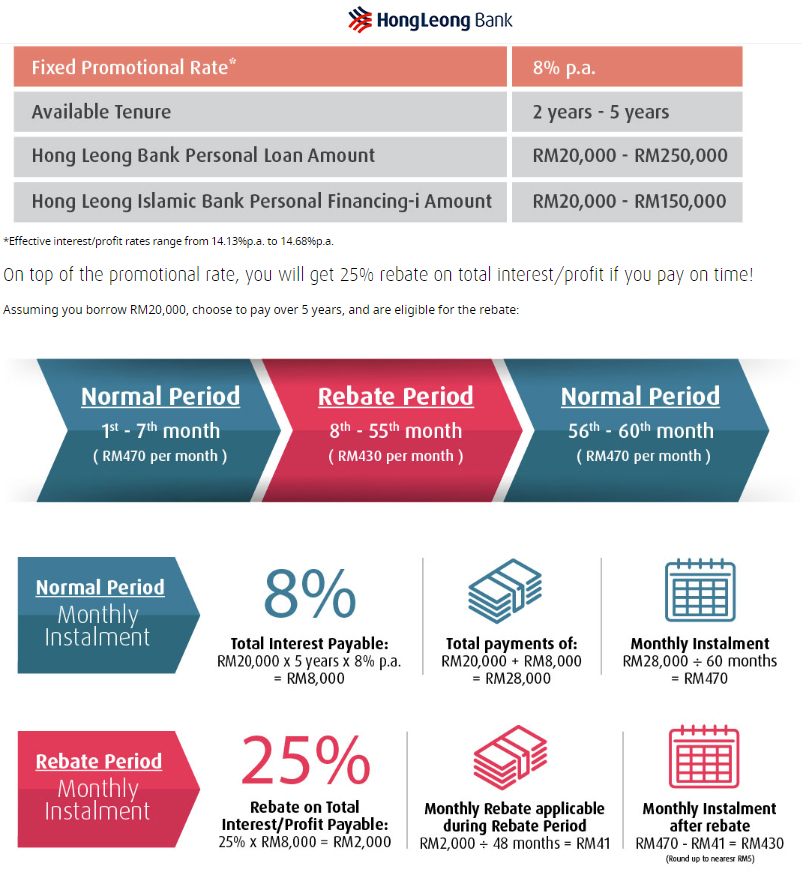

Public Bank is another option when it comes to foreign currency fixed deposit. Do know that the minimum amount required is RM10,000 with deposit period up to 12 months. The interest rate will be calculated based on the number of days that the deposit is being kept and will be paid in the same currency in which the deposit is made. One important point to take note is that premature withdrawal is allowed provided that the deposit has been placed for at least 15 days. Also, half the interest applicable daily will be paid to the deposit holder. Hong Leong Bank offers foreign currency fixed deposits in more than ten foreign currencies, besides offering preferential foreign exchange rates. These help to maximize returns on the foreign currency deposits. In addition, the banks offers free account statement every month and charges an optimum fees for any related services.

There are also OCBC Bank and UOB Bank offering foreign currency fixed deposit. OCBC Bank’s foreign deposits are only for Malaysians or customers with Malaysian PR, aged above 18 years old. The minimum amount of deposit is RM10,000 in any top currencies and the maximum period of deposit is 12 months. On the other hand, the UOB foreign currency fixed deposit is only available for Malaysians with age 21 years old and above. This is a good option if you wish to grow your money via foreign currency fluctuations. One benefit is the flexibility on the tenure, which can be in between 1 to 12 months depending on your choice.

Citibank also offers foreign currency fixed deposits with choices from over ten different currencies. The minimum amount of deposit required is USD 3000 with tenure ranges from 1 to 12 months. Do take note that these deposits are eligible for PDIM protection according to the bank’ guidelines. For the foreign currency fixed deposits with Alliance Bank, you must be at least 18 years old and above in order to apply, in which the account can be availed either individually or jointly. Deposits from Alliance Bank offer competitive interest rates to its customers. One great benefit of this deposit is that it can be redeemed based on the market current exchange rate of the currency deposited. The bank offers these foreign currency fixed deposits through a huge network of branches. Nevertheless, foreign currency fixed deposits are also available from Standard Chartered Malaysia. These deposits are flexible to maintain and you may remit or convert at a favorable rate.

With so many banks offering foreign currency fixed deposits, it is advisable to look for one that suits you the most, from the amount to the purpose for depositing your money. Some deposits may be more suitable for business purposes while some may be suitable for customers who have children studying abroad or those who are employed overseas. All details in regards to these deposits are available to customers via online banking.